Thank you for considering a planned gift to Jubilee Fund!

Through your generous gift to the Jubilee Fund’s Planned Giving campaign, you ensure that Jubilee Fund is able to continue providing financial stability to Manitoba’s Non-Profit community as well as marginalized individuals. There is well over 86,000 non-profits in Manitoba, many of which have a direct or indirect approach to poverty reduction. Your planned gift will help ensure Jubilee Fund is able to continue helping create:

- Rent-geared-to-income housing units

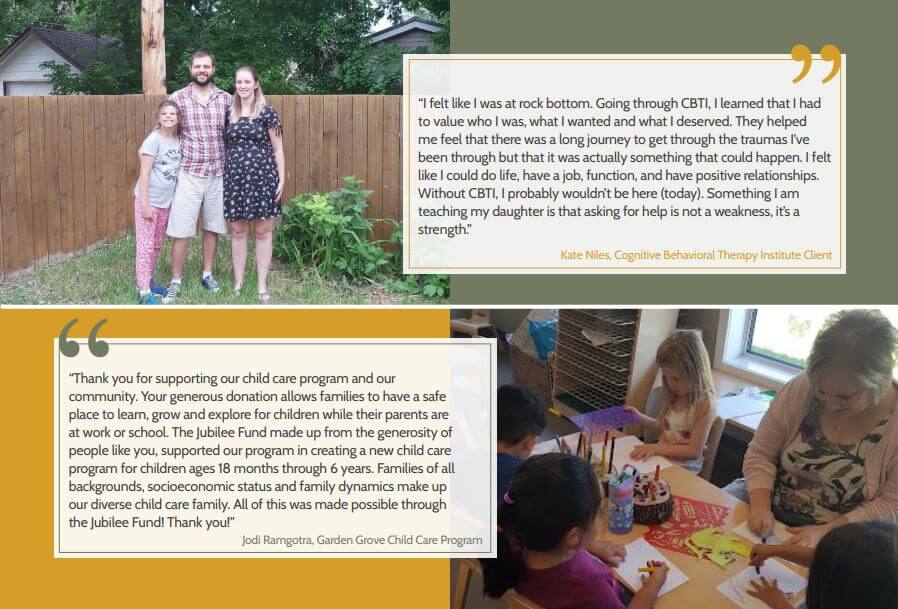

- Subsidized child care spots

- Mental health supports

- Accreditation transfer for newcomers

- Job readiness training for marginalized youth and underemployed community members

- and more!

Planned Giving Campaign Goals

By 2031, Jubilee Fund intends to have a loan fund in the amount of $10,000,000. This will allow for 50% of Jubilee Fund operations to be supported from interested generated from investments and Jubilee Investment Certificates donated through the Planned Giving Campaign.

Our Planned Giving Campaign was launched in 2022 through the generosity of CHAM, Missionary Oblates of St. Boniface, Provincial Administration Sisters, as well as four individuals who have chosen to remain anonymous. Combined, these Planned Gifts totaled over $500,000 in planned gifts.

We hope to realize the following cumulative results:

- 2022: 10 outright Jubilee Investment Certificate donations, 1 planned gift such as a stock or insurance

- 2023: 12 outright Jubilee Investment Certificate donations, 3 planned gifts such as stock or insurance

- 2024: 15 outright Jubilee Investment Certificate donations, 5 planned gifts such as stock or insurance

How can you make a planned gift?

Leave a planned gift in your will

- For sample wording for three simple ways you can put a charitable gift in your will, click here.

Once you have made a planned gift in your will, we encourage you to let us know so by completing this Bequest Donation Intent Form – Jubilee Fund so we can recognize your thoughtful generosity.

Purchase a Jubilee Investment Certificate (JIC) or donate your current JIC at maturity

To learn more about purchasing a JIC or donating your current JIC for a full tax receipt, email Courtney Neufeld or call her at 204-589-5001 ext.2.

Make a gift of stock or privately owned securities

Gifts of securities can be made through Canada Helps, or you can complete this Securities Donation Form – Jubilee Fund.

Make a gift of fixed value preferred shares

Please email Courtney Neufeld for more information or call her at 204-589-5001 ext.2.

Donate a Life Insurance policy

By naming Jubilee Fund as the beneficiary of your policy, your estate will receive tax benefits. If you designate Jubilee Fund as the owner and beneficiary of the policy, you can realize those tax benefits today.

There are several ways to make a gift of life insurance. You can:

- Name Jubilee Fund as the beneficiary of your insurance policy. Upon passing, your estate will receive a donation receipt for the full amount that Jubilee Fund receives under the terms of your policy.

- Establish a new policy that designates Jubilee Fund as the owner and beneficiary. You can then claim any and all premium payments as a charitable donation on your tax return.

- Transfer ownership of an existing policy with premiums still owing. Jubilee Fund will issue a donation receipt for the cash surrender value of the policy. When you make further payments, Jubilee Fund will issue additional annual donation receipts for the value of the premiums.

- Donate a fully paid policy you no longer need. Jubilee Fund will immediately issue a donation receipt for the policy’s cash surrender value, plus any accumulated dividends and interest. In order to issue a donation receipt, Jubilee Fund must be irrevocably designated as the policy owner and beneficiary.

The benefits of giving a gift of life insurance include:

- There is no need to involve a lawyer and no legal fees

- They are private

- They can’t be contested.

After seeking appropriate professional advice and ensuring your loved ones are provided for, visit your insurance broker. You will need our legal name and charitable registration number:

Legal Name: The Jubilee Fund Inc.

CRA Charitable Business Number: 86758 5481 RR0001

If you have arranged for a gift of life insurance, we encourage you to let us know so we can recognize your thoughtful generosity.

In all cases when making a planned gift to Jubilee Fund, we strongly advise you connect with your trusted advisor.

For information about leaving a planned gift to Jubilee Fund, please complete the online form below. Or if you would prefer, you can call Courtney Neufeld at 204-588-5001 ext 2. or email her.